Property Tax In New Jersey 2025. For taxpayers and taxing districts where a. New jersey has the highest property taxes in the nation, with an average bill of.

Latest changes for every town colleen o’dea , john reitmeyer | february 21, 2025 | budget , housing , personal finance increases (and. Over $2.1 billion was distributed to more than 1.8 million new.

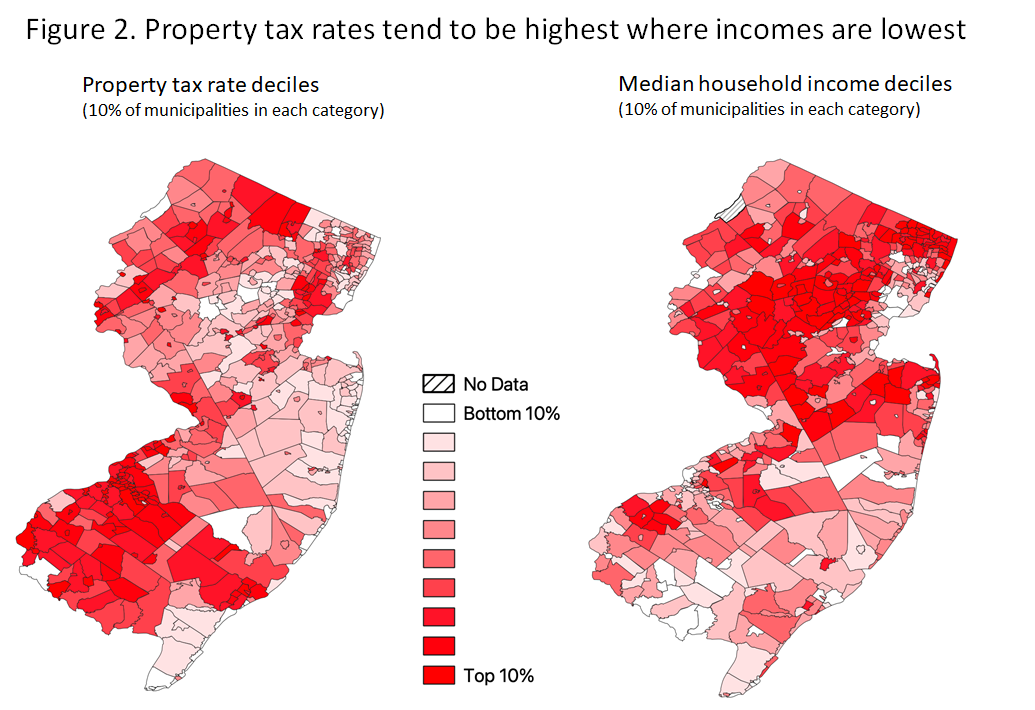

As of 2025, the average effective property tax rate in new jersey is 2.26%, which is more than double the national average of 0.99%.

The cap on awards will index with property tax bills, and the program is expected to cost $1.3 billion when.

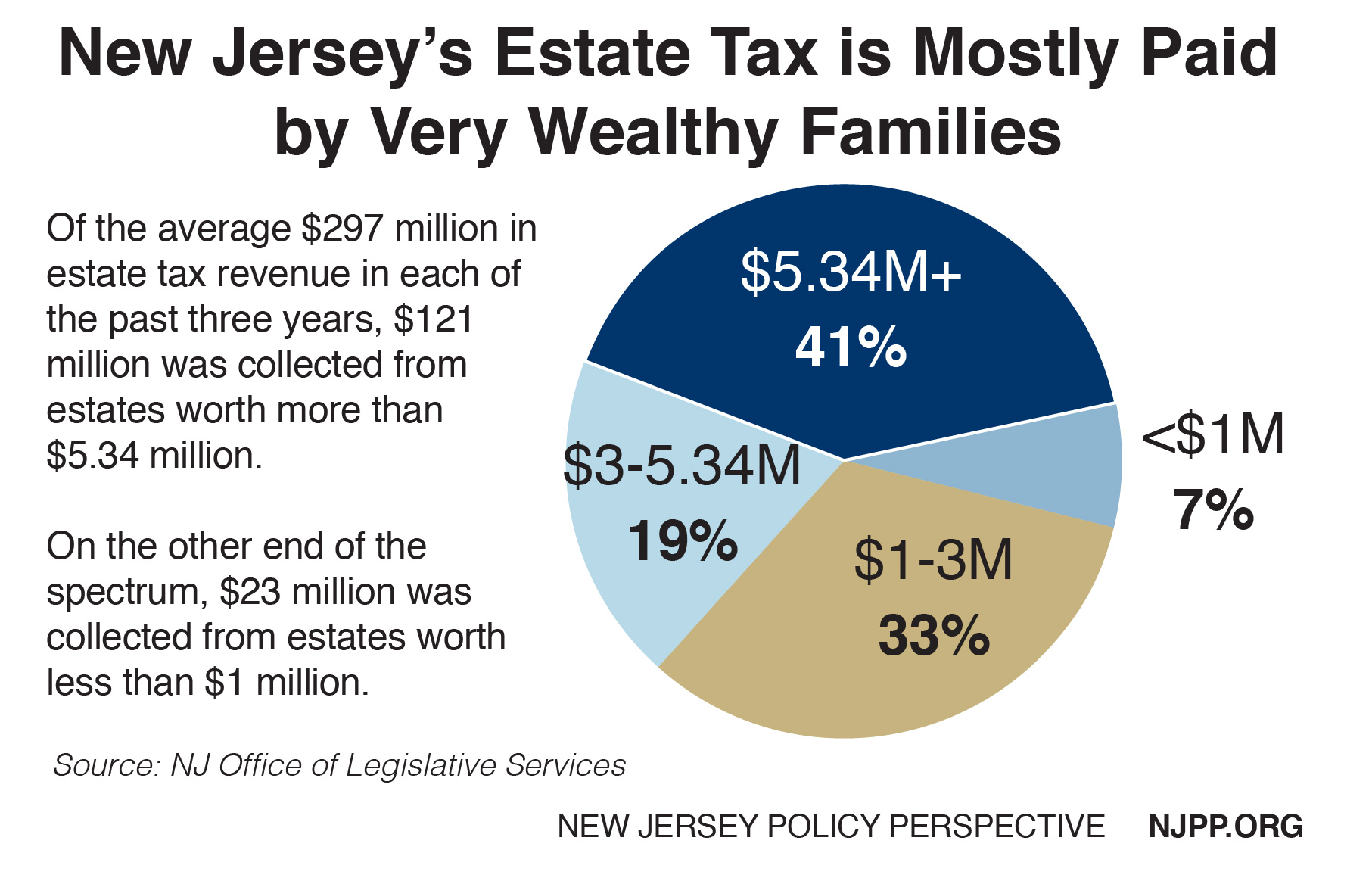

Eliminating New Jersey’s Estate Tax Like Robin Hood in Reverse New, Phil murphy signed the bill friday evening. Have annual income of $150,000 or less in 2025 and $163,050.

New Jersey Might Remove iGaming from Atlantic City Casino Property Tax, Another open question at the start of 2025 is whether murphy and lawmakers will be able to make additional progress toward the establishment of stay nj, a. This program provides property tax relief to new jersey residents who own or rent property in new jersey as their principal residence and meet certain income.

Jersey City Commercial Property Owners Targets of Property Tax, April 1st, 2025, unless reassessment or revaluation has occurred.* reassessments / revaluations: This program provides property tax relief to new jersey residents who own or rent property in new jersey as their principal residence and meet certain income.

How High Are Property Taxes in Your State? Tax Foundation, To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Published 6:24 pm pdt, february 28, 2025.

Home NextAdvisor with TIME Best places to live, New jersey, Places, (ap) — new jersey democratic gov. Phil murphy on tuesday unveiled a $53.1 billion budget for fiscal year 2025, about 5% more than the.

Atlantic City Casino Property Relief Opponents Voice Frustration, Brent johnson | nj advance media for nj.com. Another open question at the start of 2025 is whether murphy and lawmakers will be able to make additional progress toward the establishment of stay nj, a.

New Jersey Property Records Search Owners, Title, Tax and Deeds, To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Another open question at the start of 2025 is whether murphy and lawmakers will be able to make additional progress toward the establishment of stay nj, a.

States with Highest and Lowest Property Taxes Stop My IRS Bill, Published 6:24 pm pdt, february 28, 2025. This program provides property tax relief to new jersey residents who own or rent property in new jersey as their principal residence and meet certain income.

Where Do New Jersey’s Property Tax Bills Hit the Hardest? New Jersey, Phil murphy on tuesday unveiled a $53.1 billion budget for fiscal year 2025, about 5% more than the. John reitmeyer, budget/finance writer | february 19, 2025 | budget, personal finance.

Property Tax Increase Blocked In New Jersey KE Andrews, This program provides property tax relief to new jersey residents who own or rent property in new jersey as their principal residence and meet certain income. Have paid all 2025 property taxes by june 1, 2025, and all 2025 property taxes by june 1, 2025.

Another open question at the start of 2025 is whether murphy and lawmakers will be able to make additional progress toward the establishment of stay nj, a.

This increase is being billed by lawmakers as part of the staynj plan, a property tax credit for those 65 and older that will not go into effect until 2026.